What The Budget Announcement Means For Our Clients

With the General Election less than two months away, this is an important Budget. We’ve got a panel of experts on hand to explain the legal implications of the big announcements.

From midday onwards, we’ll be updating this page to keep you up-to-date on George Osborne’s announcements. You’ll be able to get the expert views of Partners from around our firm, including:

.jpg)

Once the announcement begins, press F5 or hit refresh on your web browser to make sure you’re getting the latest updates.

Live Updates:

1702: Research & Development Tax Credits

"The Government is to implement a package of measures to improve the accessibility of R&D tax credits for smaller businesses."

Alex Barnes,

Tax Partner

1657: Business Investors

"There will be amendments to the Seed Enterprise Investment Scheme (SEIS), the Enterprise Investment Scheme (EIS) and Venture Capital Trusts (VCTs) to increase investment into those small companies that benefit from these schemes. Subject to state aid approval the Government will increase the cap on investment a company can receive under the EIS and VCT scheme to £15m or, £20m for knowledge intensive companies and will smooth the interaction between the schemes by removing the minimum spending requirement of SEIS companies before EIS or VCT funding can be raised."

Alex Barnes,

Tax Partner

1653: Entrepreneurs' Relief

"The Government will legislate to deny entrepreneurs’ relief (ER) to those that invest in contrived structures set up so that people with only a small indirect stake in a trading company can benefit from ER. This will effect disposals on or after 18 March 2015.

"On the positive there will be review of the availability of ER to academics who dispose of shares in spin out companies that use intellectual property to which they have contributed."

Alex Barnes,

Tax Partner

1646: Pensions

"The Chancellor also announced the much trailed Consultation on changing the law to allow existing annuitants to access their annuities via sales in a new market. The current 55% tax charge for this is to be removed and replaced with marginal rate tax on cash payments to individuals. Whilst this can be praised for extending pension freedoms to those who have already bought annuities, there is still no clarity over safeguards. In some cases if individuals sell annuities but are still working, this sale could push them into a higher tax bracket. Nor has the Chancellor made clear whether this new law applies to annuities for individuals only or those held by occupational pension schemes too.

“I have real concerns over the timescale of this implementation for the pensions industry. Trustees of occupational schemes and employers are already dealing with auto enrolment changes and are struggling to deal with last year’s announcements on pensions freedoms and choice changes. The industry now needs time to settle down, and not be stressed even further with further changes.“

Nigel Bolton,

Pensions Partner

1609: Business Rates

“The issue of Business Rates is key for many SMEs and for many company owners, they will be looking closely at this over the next year to make sure plans for a ‘major review’ are backed up with action.”

Steve Beahan,

Partner and SME Specialist

1604: Infrastructure and Transport

"Our recent survey revealed that infrastructure investment was amongst the top priorities for SMEs ahead of this Budget and it appears the Chancellor has delivered in some sectors of the economy and in some parts of the country. Transport investment of £7billion was confirmed for the South West, whilst in the North of England there was an announcement in relation to a transport strategy for the region and a new city deal for the West Yorkshire Combined Authority. A new £60million Energy Research Accelerator in the Midlands was given the go ahead, whilst there was also an extension of eight enterprise zones across Britain, with new zones in Plymouth and Blackpool."

Steve Beahan,

Partner and SME Specialist

1437: Inheritance Tax - Deeds of Variation:

“The announcement of a review into Deeds of Variation, which are a way of minimising the amount of inheritance tax that has to be paid, may provoke a rush of people seeking to use them in the event that they may be withdrawn in future.

“Deeds of Variation are currently a legitimate and well used tax-planning tool whereby people have a window of two years from the death of a person to redirect any inheritance received from that person to another to reduce Inheritance tax in their own estates.”

Gillian Coverley,

Probate, Estates and Tax Partner

1415: Help To Buy ISA:

“The Help to Buy ISA is intended to get more first-time buyers onto the market by helping them save for a deposit. We’ve seen the number of property completions rise steadily over the past year and if more fist time buyers are able to make their step onto the housing ladder it will inevitably enable second and third time buyers to move up the chain.

“More buyers with deposits available will give the whole housing industry another boost but could potentially lead to house price rises and inflated values as there is much more competition at the bottom end of the market.”

Gillian Coverley,

Probate, Estates and Tax Partner

1346: Up to 5million pensioners to be able to access money locked in annuties from April 2016.

1342: George Osborne: "the threshold at which people pay the higher tax rate will rise not just with inflation – but above inflation."

1336: A "Help to Buy ISA" will see the Government top up savings of first-time buyers.

1334: Personal Savings Allowance to mean 95% of savers will no longer pay tax on their savings.

1329: Personal Tax Allowance up to £11,000 per year, by 2016.

1325: £600 million to be help improve digital infrastructure, broadband and mobile phone networks. The Government has also committed to bringing "ultra fast" to the whole of the UK.

1323: The Self Assessment Tax Return will be abolished and replaced with an online "digital tax account".

1321: The Chancellor has announced support for the TV, Film and Video Game industries.

1315: Cambridge and Greater Manchester to keep 100% of increases in business rates.

1311: Measures announced to help regimental charities and military service personnel.

1308: Entrepreneur's Relief rules to be changed to ensure only available to those who sell genuine businesses.

1303: As expected, the lifetime pension allowance will be reduced from £1.25million to £1million. The lifetime allowance will be indexed from 2018.

1242: The Chancellor has announced the doubling of support for British exporters to China.

1220: Just ten minutes to go now until George Osborne is expected to begin his announcement.

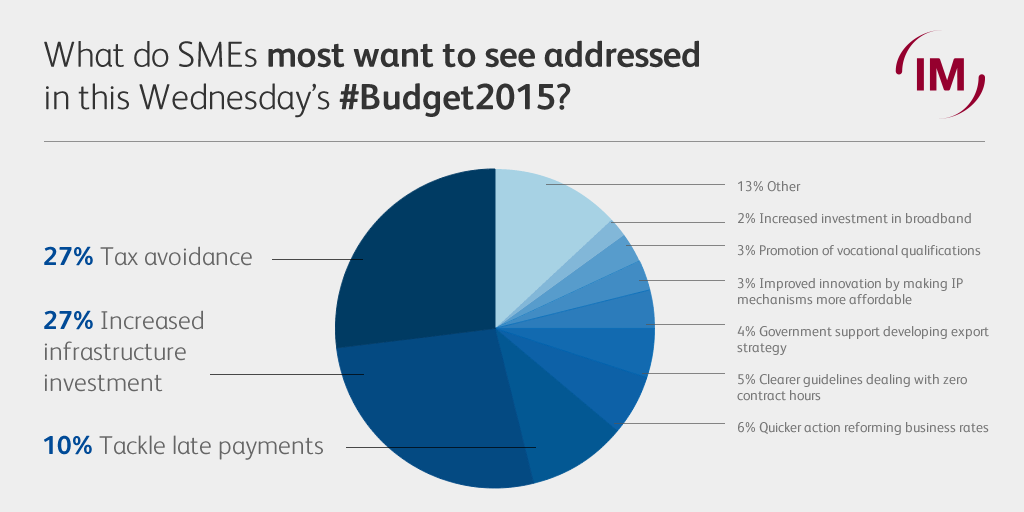

1210: When we asked SMEs what they most wanted to see addressed in today's Budget, 27% wanted increased investment in infrastructure.

1200: Prime Minister’s Questions has just started. The Budget announcement will follow immediately afterwards, so it’s a packed House of Commons today.