Genuine Claimants To See Damages Cut By Around 70% Through Government Plans

One of the UK’s largest law firms has warned that plans to raise the small claims limit to £5000 for road traffic accident (RTA) cases will not deliver lower car insurance premiums, could leave genuine claimants short-changed and will not tackle fraud.

Experts at Irwin Mitchell have urged the Government to ‘think again’ on ways to tackle car insurance premiums and to adopt a cross-industry approach to the issue after research found that consumers could see their damages for genuine injuries cut by around 70% overnight if ministers push ahead with their plans.

The firm said it backed the Government’s bid to drive down rising insurance premiums but pointed to analysis of 500 recent cases concluded by its lawyers which demonstrated that where clients of Irwin Mitchell sought their advice they were able to achieve an average increase of 218% in the damages recovered compared to the average of offers made by an insurer before medical evidence was available.

Irwin Mitchell said the Government’s proposals would leave thousands of road traffic accident victims having to make their case without legal advice through the Small Claims Track, funding their case out of their own pockets, or representing themselves against lawyers acting for the insurance companies. They would be left to work out for themselves whether the insurer’s offer of compensation is appropriate and many would simply give up and not bring their case at all or not obtain the level of compensation they were entitled to.

It also said that the current portal system would need to be rebuilt if it was to be appropriate for use by individual claimants and that any simplification of the system would remove many of the controls currently in place to tackle fraud and risk turning the system into a ‘fraudsters’ charter’.

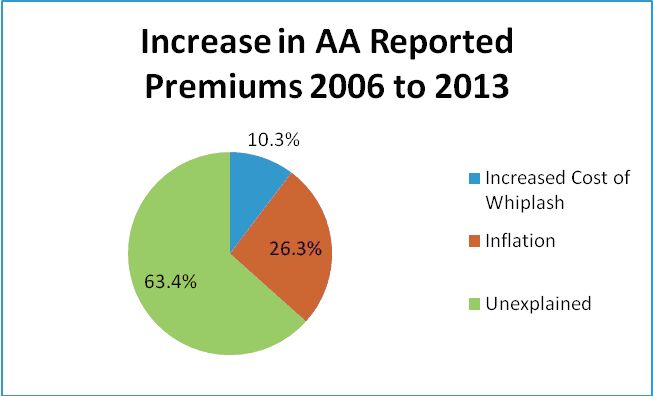

Irwin Mitchell challenged the view that whiplash was the sole driving force behind rising premiums, after its analysis showed that the vast majority of the increase in premiums remains unexplained. Of the increase since 2006, Irwin Mitchell said 10.3% was from an increase in whiplash claims and 26.3% was down to inflation, but the vast majority of the rise, 63.4%, is unexplained.

Stuart Henderson, Managing Partner, Personal Injury, said: “These changes are intended to reduce the cost of motor insurance premiums, but whiplash is only part of the reason premiums have been rising. While we agree that reform is needed, there is no evidence to suggest that consumers will see any reduction in their insurance premiums as a result of these proposals. Instead, many thousands of genuine accident victims will be left without legal advice when they are seeking redress for often serious injuries. The Government needs to think again.”

Although the focus of attention has been on whiplash, the proposed increase would capture many other types of injuries too. Victims of these injuries will find that they have to represent themselves without any legal support in order to claim compensation.

Examples of the types of injury that could be valued at less than £5k

(11th Edition Judicial College Guidelines):

- Minor brain or head injury - £1,575 to £9,100

- Less severe PTSD - £2,800 to £5,875

- Minor eye Injuries - £2,800 to £6,250

- Slight hearing loss or tinnitus - Up to £5,000

- Collapsed lung with full recovery - £1,575 to £3,825

- Significant hip/pelvis injury (2 yr) - Up to £5,500

- Loss of part of finger - £2,800 to £5,600

- Fractured nose with surgery - £2,800 to £3,650

- Loss of two front teeth - £3,100 to £5,430

Henderson added: “Compensation is not a ‘lottery win’ for victims. It is there to provide much needed support and to help them cover essential costs incurred as a result of their injury. We know that legal advice is often vital to ensure that victims can get the redress they are entitled to.

“We are calling for a cross-industry approach to help Government deliver a solution that will protect victims while helping to prevent fraud and cut motor insurance costs. This will require industry to work together to share information, and full backing for proposals to ensure that all claimants undergo a fully independent medical assessment.

“A better deal for motorists is needed. We believe that there is good and bad practice across the whole value chain of the industry. Changes can be made which will have a positive impact on the validity of claims and the cost to insurers.”

These changes could include:

- The accreditation of medical agencies and reporting doctors

- Creating a framework to ensure the independence of reporting doctors

- The requirement for a medical report before compensation is paid to remove opportunistic claims

- Full assessment of the current RTA Portal and the reforms being introduced in April 2013 with an ongoing working party of industry stakeholders to make further recommendations for change as the impact of current reforms become clear

- An obligation on insurers to engage in data sharing around fraud. The Government supports this but is silent as to how this is to be advanced

- Action to improve engagement in the RTA Portal by insurers so that a higher proportion of legitimate actions can be dealt with in the current low cost system.