Have the floodgates opened for tenants to reclaim overpayments of insurance rent?

A recent High Court decision (London Trocadero (2015) LLP v Picturehouse Cinemas Ltd and other companies [2025] EWHC 1247 (Ch)) resulted in the landlord of the Trocadero Centre in London being required to reimburse one of its tenants £700,000 in overpaid insurance rent dating back almost 10 years. Whilst, ultimately, the case turned on what the landlord could properly recover from its tenant on the construction of the relevant clauses of the tenant's leases, the case is potentially of much wider application. Expert evidence submitted in the case suggested that the practice of overcharging tenants for insurance rent is widespread and well-advised tenants are now likely to be scrutinising their historic insurance invoices in the hopes of reimbursement.

The facts of the case

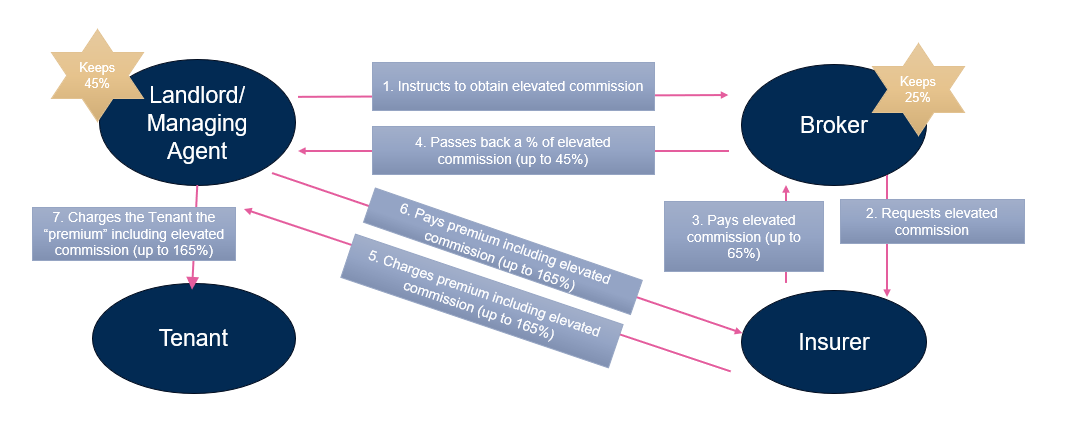

The facts of the case were complex and are very loosely summarised in the diagram below (percentages are illustrative, as they varied year-by-year in the case itself).

In essence, the landlord arranged a block insurance policy for multiple properties via its agent and a broker. The total value of the assets insured was over £4billion. It instructed the broker to request an elevated commission from the insurer. The insurer paid that elevated commission to the broker, who retained a slice and passed the remainder of the commission to the landlord. The insurer then invoiced the landlord for the insurance premium (which included the elevated commission) and the entire amount was charged to the tenant as insurance rent. The tenant was essentially footing the bill for a commission which was required by the landlord, retained by the landlord and which was not a prerequisite of insurance being available in the market. In one year, the landlord’s commission amounted to 60% of the sum charged to the tenant.

The court decided that the part of the insurance rent that corresponded to the landlord’s commission was not contractually due. On a proper construction of the leases, which permitted the landlord to recover the “premium payable by [the Landlord] for keeping the Centre insured”, the landlord could only recover as insurance rent the true premium that was payable to insure the building. Although the commission, strictly speaking, formed part of the ‘premium’ which the landlord paid to the insurers, it did not form part of the actual cost of keeping the property insured because it was paid back to the landlord.

The court also held that a term should be implied into the leases that the landlord was only entitled to demand sums by way of insurance to the extent that such sums were representative of the market rate and reflected insurance contracts negotiated at arm’s length. The dealings between the landlord, its agent, the insurer and the broker were held not to be at arm’s length.

The implications

The existence of such apparently commonplace arrangements, whereby landlords are profiting at the tenant’s expense, will not be obvious from the face of the lease. Indeed, the entire point of the case was that the lease did not allow the landlord to charge the tenant for the the part of the “premium” which was not truly payable by the landlord to insure building. Tenants will therefore need ask their landlords to disclose the amount of commission that has been or is being received under insurance arrangements and interrogate their demands and accounts. Note that under the Code for Leasing Business Premises, England and Wales 2020, a landlord should disclose to its tenants whether it benefits from insurance commissions. There is similar guidance on best practice in the RICs professional standard “Service charges in commercial property”. However, the drafting of some leases will allow landlords to retain “reasonable commission”.

The question of which sums may be recoverable by tenants is unlikely to be a straightforward one. Limitation issues may be relevant and indications are that the case will be appealed, so the High Court decision may not be the final word on the matter.