Spotlight on parent companies and environmental management - Lessons from Mariana and the Road Ahead under CSDDD

The landmark judgment on 14 November 2025 in Municipio de Mariana v BHP Group marks a potential watershed moment for international corporate accountability.

The UK High Court held that the BHP parent company headquartered in the UK and Australia was liable for the 2015 Fundão Dam collapse, despite the disaster occurring in Brazil and being operated by a joint venture rather that BHP directly.

I’ve been considering the combined implications of the Marina judgment and the EU Corporate Sustainability Due Diligence Directive on parent companies. In my view, there is now greater accountability on boards of directors to identify and prevent environmental harm across global operations.

Enhanced Parent Company Responsibility

English courts have traditionally been reluctant to pierce the corporate veil between parent and subsidiary companies, except in circumstances where there was fraud or serious wrongdoing.

In Marina, the High Court found that BHP exercised significant control or oversight over the joint venture’s operations.

Boards must now recognise that accountability extends beyond direct operations. Parent companies need to anticipate and mitigate risks in subsidiaries and joint ventures, particularly where strategic influence and profit-sharing exist.

A Closer Look at Corporate Accountability in Environmental Disasters

Raising the Bar for large UK Companies

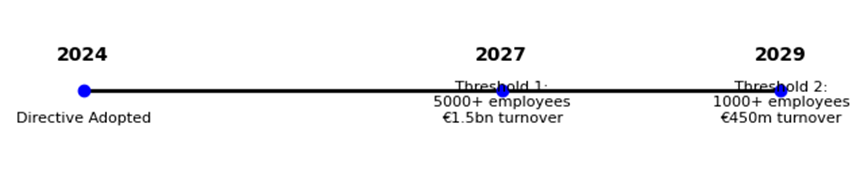

The EU Corporate Sustainability Due Diligence Directive (CSDDD), effective July 2024, will apply from 2027 onwards, with phased thresholds:

- 2027: EU and non-EU companies with 5,000+ employees and €1.5bn global turnover.

- 2029: Companies with 1,000+ employees and €450m global turnover (including UK parent companies with significant EU operations).

CSDDD imposes mandatory human rights and environmental due diligence across global value chains and requires a climate transition plan. Non-compliance risks include civil liability and fines of up to 5% of global turnover.

Where serious adverse impacts persist despite rectification attempts, firms should, as a final measure, discontinue business relations with the relevant stakeholder

Managing environmental risks

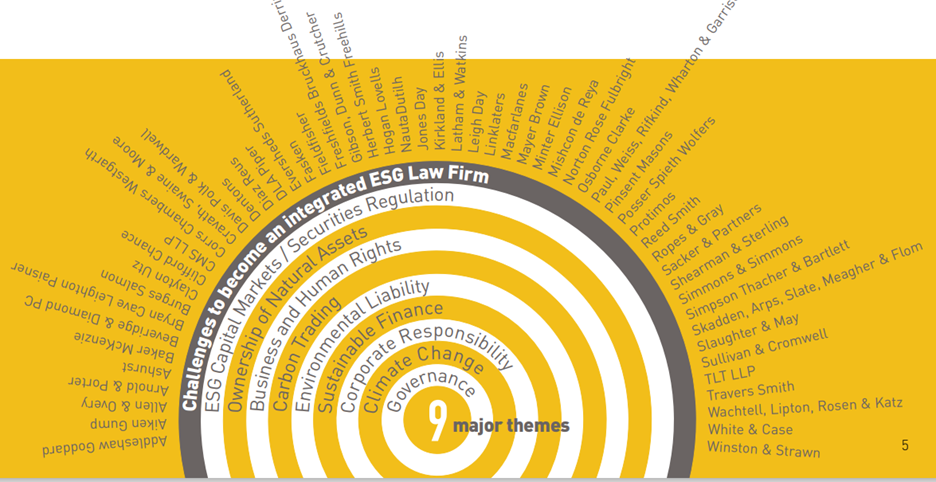

Environmental risks play a major role in ESG management. Back in 2021, the Blended Capital report “Chasing the Dragon” highlighted that climate change and environmental liability were two of the major themes for companies.

ChasingTheDragon_120321_0050.pdf

The table below provides examples of environmental due diligence considerations for managing environmental risks across subsidiaries and value chains.

| Infrastructure projects | Pollution and chemicals | Climate change

|

Map global operations and high-risk activities

| Identify and sell or insure contaminated sites to prevent them becoming stranded assets

| Implement a climate transition plan with measurable targets for reducing greenhouse gas emissions

|

Implement environmental due diligence risk systems with effective management supervision and monitoring

| Replace PFAS-based products and coatings with safter alternatives

| Identify climate risks and opportunities within the group

|

Ensure that environmental insurance covers potential incidents and litigation

| Check phase out dates for persistent organic pollutants so there are no supply chain issues

| Ensure that buildings and products meet government standards for energy efficiency standards

|

The Mariana judgment is a historic precedent for multinational accountability. Combined with CSDDD, it signals a new era where corporate responsibility is enforceable, not aspirational.

Failure to carry out environmental due diligence for subsidiaries and to implement an environmental risk management system across global operations could result in substantial fines, litigation and reputation damage.